Services for Couples and Individuals

How We Can Partner With You

Being Mindful in Divorce provides services to individuals, couples, mediators and attorneys for the financial expertise to ensure that their divorce process is financially responsible and amicable; providing a smooth transition to create the life that you choose to live with clarity and peace of mind.

Not going through a Divorce? Working as a Personal Financial Coach, with a background as a Certified Financial Planner, I can guide you as a “financial thought partner”; providing information and a firm foundation though life changes and preparing you to work with a Financial Planner.

Women make $.82 for ever $1.00 a man earns. “While 82 cents vs. $1 may not seem like much, over the course of a lifetime, it adds up. The Bank of America Merrill Lynch study states that if a man and woman work full time until retirement, a woman will earn $411,000 less.“

How We Can Partner With You

Being Mindful in Divorce provides services to individuals, couples, mediators and attorneys for the financial expertise to ensure that their divorce process is financially responsible and amicable; providing a smooth transition to create the life that you choose to live with clarity and peace of mind.

Not going through a Divorce? Working as a Personal Financial Coach, with a background as a Certified Financial Planner, I can guide you as a “financial thought partner”; providing information and a firm foundation though life changes and preparing you to work with a Financial Planner.

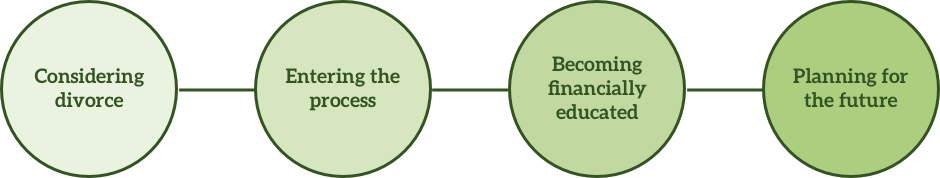

We Can Help You Through All Stages of Divorce

The following professional services include:

hidden

Personal Financial Coaching

65% of college-educated, not yet retired women say they are NOT comfortable managing their investments compared to 40% of men.

42% of all women LACK financial security.

ONLY 7% of women are “very confident” in their ability to fully retire.

ONLY 18% of families headed by single mothers have financial security.

Maybe you’ve gotten your first job or a big promotion, or your parents just never taught you about money or you have credit card or student loan debt. Maybe you have just gotten divorced or widowed, maybe you are married and never really took the initiative in finances during your marriage.

Women make $.82 for ever $1.00 a man earns. “While 82 cents vs. $1 may not seem like much, over the course of a lifetime, it adds up. The Bank of America Merrill Lynch study states that if a man and woman work full time until retirement, a woman will earn $411,000 less. “

Regardless of the circumstances that bring you here, I am committed to the economic empowerment of women, because I know that if my grandfather had not taught me early on about money that I never would have been able to weather 7 out of the 10 of life’s big transitions. This includes a job loss, career change, relocation, owning a home, and a seriously expensive divorce. As a Financial Coach, having been through this myself, and being trained as a CFP, I have the emotional and professional experience to support you in seeing things at a high-level, playing devil’s advocate, as well as providing financial education to help you make the right decision for your financial next steps.

We’ll help you:

- Identify, prioritize and quantify goals so that you’ll know when you met them

- Organize your financial information and develop a savings plan

- Create a debt payoff plan

- Develop strategies to support you in overcoming obstacles

- Understand the critical markers for measuring your financial improvement

“Thank you so much for our meeting with me last year. (Since then) I have purchased my first home, and have over 20K in my savings accounts because of the plan that we put together. Thank you for all the knowledge and your help!” – JD, AZ

“In the last year that I have been working with you, my net worth has increased substantially. A big part of that is due to your guidance in helping me understand my finances and investment accounts better… I appreciate that you are always available and that you are passionate about your work, thank you again for all your help this year and I look forward to working with you this upcoming year”. – IA, AZ

Financial Planning Before Divorce

Marriage and divorce are both common experiences nowadays, We have all heard the statistic that 50% of all marriages end in divorce and that this number is even higher for 2nd and 3rd marriages.

So what does that mean for you? The dissolution of a marriage is emotional, it can be stressful, and it can be devastating financially. From a financial standpoint it is no different than the dissolving of a business partnership, and should be given the same level of expertise and care. But more importantly it involves people lives, their hopes and dreams, the livelihood of their families, and as such, emotions need to be set aside so that you can work to mindfully and clearly focus on your financial future.

It’s not only important to be financially educated, but also to work with people who understand you. This a time when many concerns are surfacing; How financially secure will you be after the divorce… and for how long? Will you be able to maintain your standard of living and your relationships after it’s all said and done? How will you support yourself and your family on your own? Will you lose assets you brought to your marriage?

At Being Mindful In Divorce, we can work with you before your divorce decision to help you understand options and develop the best financial solutions for you and your family

Contact us to schedule your Divorce Strategy Session today!

Divorce Mediation Assistance

Mediators and even Attorneys may struggle with the complexity of property division, tax impacts, pension valuations, providing alternative settlement options, and optimizing settlements on both a Cash-flow and Net Worth basis 10,20-30 years into the future. Sometimes keeping the home is not the best decision. Self-employment income is difficult to determine. Determining the length of spousal is unclear. We can help you with all that and more.

We partner with these professionals to provide divorce financial planning expertise to their clients in support of the divorce process. Divorce settlement mistakes can last a lifetime, with advanced training and customized reports, we can help develop creative settlement options that make financial sense for both parties and create peace of mind.

Collaborative Divorce

Your marriage may be over and you understand the importance of working together to make the best financial decisions for your family. Collaborative divorce is a voluntary divorce resolution process that offers the services of legal, mental health, and financial professionals working together as a team in non-adversarial fashion; without litigation. Divorce is always difficult but having a team to help you come to quicker resolution without litigation can ensure you have control over the decisions, protect privacy, and reduce costs.

The collaborative processes involves a few unique points, including:

1. Both parties and the entire team signing a collaborative agreement that outline the scope and nature of the their participation in their roles and stipulates that the parties are all committed to resolution and will not go to court to resolve their differences.

2. The parties agree to voluntarily provide all relevant and requested information as part of the full disclosure settlement process and negotiate in full faith to reach a mutually agreed upon settlement.

3. Each party is represented by an attorney to ensure they feel heard and receive proper counsel. The attorney participation will terminate immediately in the case of any contested court proceeding.

4. The experts are engaged “as necessary” and their participation will terminate immediately in the case of any contested court proceeding.

5. The couple may always jointly engage other professional as needed. For example a Mortgage Broker, a Business Valuation or Insurance expert etc.

The collaborative process is about you and your family; with a team to support your values. It keeps control and confidentially in your hands and not in the courts. It allows parties to negotiate outcomes that are right for their families, honoring their priorities and exploring creative solutions that cannot occur in the litigation process. For more information about the Collaborative divorce process, please visit the web page of the Collaborative Professionals of Phoenix

Certified Divorce Financial Planning

Maybe you are considering this step. Sometimes divorce is the only answer and you both agree. You are in a place in your lives where you can sit together, define priorities, negotiate an agreement, and value avoiding a costly litigation. Maybe you have used financial planning in the past, and even if you haven’t – you understand it’s importance to your long range financial outcome and acknowledge that you don’t know where to begin. Consequently, you value the financial guidance the divorce financial analysis process can bring in creating an equitable future for you both.

You have created a life that may include a home, a business, investment and retirement accounts (pension, IRA, 401K, TSP etc.) executive compensation, real estate or more. Reports reflecting your unique situation help in the development of financial “after tax” division that seeks to save taxes, avoids pitfalls, and let’s you know what your “post-divorce” lifestyle will look like. The transparent process puts control in your hands and allows you to see the future impact on your cash-flow and net-worth; not just a snapshot of this moment, because 50/50 is not always equitable when we take these aspects into consideration.

Financial Neutral

We’re here as your neutral “financial thought” partner, answering questions, posing questions, and making suggestions; to empower you both together to develop a settlement that honors your values and financial well-being.

Divorce Team Member/Financial Advocate

If you are working with an attorney, we can become part of your divorce team and provide key financial support for previous issues mentioned.

As well as:

- Creation of, or review and validation of completed financial affidavit forms.

- Presentation, litigation case support, and expert witness services in court or during mediation proceedings.

"Forensic Type" Analysis & Valuation

Maybe your spouse has self-employment income, maybe the tax returns don’t show the true cash-flow that has supported your family, maybe documents are disappearing or cannot be found.

It may make sense to hire a Financial Professional (FP) with an engagement for limited scope analysis work; perhaps a lifestyle analysis, cash flow analysis, or to identify changes in net worth that are incongruent with the tax return. This baby step approach can help keep costs down and determine if further analysis needed. The FP can begin by examining the individual Financial Affidavits, tax returns (personal & business), bank statements and the credit cards to identify undisclosed/hidden assets, funds used for non-marital expenses, personal expenses hidden as business expenses that reduced the profit of the business, overpayment of taxes (to reduce income), even double dipping on expenses etc.

Post-Divorce Transition Support

“Studies show that in the first year after divorce the wife’s standard of living may drops n average 27%, while a man’s rises 10%“

Most of the divorce upheaval is behind you, but you have concerns on how to keep your finances on track so your money will last. You know the amount of your divorce settlement; but your not sure how to ensure it will continue to be enough to cover your day-to-day living expenses, pay for college and get you all the way through retirement.

Will you outlive your assets? How can you ensure you can keep the assets you most treasure, rather than later selling them to survive?

In many cases once the divorce is finalized, the process is not complete; accounts and property may need to be titled in your name, old accounts may need to be closed, a QDRO may need to be executed, Wills/Trusts/Powers of Attorney etc. may need updating. Now this can seem overwhelming but you are not alone.

As a CERTIFIED FINANCIAL PLANNER™ with a background in Wealth Management, training in Estate Planning, Taxes, and Risk Management and as a Life Coach, I have the knowledge and experience to help you identify gaps in your current financial life, work with you to create a road map to meet your life goals and work with your trusted professionals (accountant, estate planning attorney & insurance agent) to maximize the implementation of recommendations and increase your chances for success.

56% of married women leave investment and long-term financial planning decisions to their husbands, and 85% of women who defer to their husbands believe their spouses know more about financial matters

Let us help you navigate this next phase of your life, and be your financial thought partner in creating “what’s next” with confidence.

Support services and Financial coaching in the following areas:

- Financial literacy around Investments; opening & consolidating accounts

- Retirement planning concepts and considerations

- Education Planning options & strategies

- Estate Planning gaps and areas for potential change or consideration

- Tax Planning concepts & strategies

- Insurance Planning & Risk Management concepts & gaps

“Michelle – Thank you, thank you, thank you, I can tell you are God-sent… completing the budget and exercises brought so much hope and peace.. seeing the light at the end of the tunnel and seeing hope in having control over my finances and moving to self-sufficiency, investing, and prospering.“ – MB, CA

“Michelle is honest, professional and incredibly hard-working. Her knowledge helped me through my divorce. She would be a true asset at the beginning of your divorce, after your divorce and comes with my heart felt recommendation. Thank you Michelle for everything you did for me!!” – Rosa Rabago, AZ

Personal Financial Coaching

65% of college-educated, not yet retired women say they are NOT comfortable managing their investments compared to 40% of men.

42% of all women LACK financial security.

ONLY 7% of women are “very confident” in their ability to fully retire.

ONLY 18% of families headed by single mothers have financial security.

Maybe you’ve gotten your first job or a big promotion, or your parents just never taught you about money or you have credit card or student loan debt. Maybe you have just gotten divorced or widowed, maybe you are married and never really took the initiative in finances during your marriage.

Women make $.82 for ever $1.00 a man earns. “While 82 cents vs. $1 may not seem like much, over the course of a lifetime, it adds up. The Bank of America Merrill Lynch study states that if a man and woman work full time until retirement, a woman will earn $411,000 less. “

Regardless of the circumstances that bring you here, I am committed to the economic empowerment of women, because I know that if my grandfather had not taught me early on about money that I never would have been able to weather 7 out of the 10 of life’s big transitions. This includes a job loss, career change, relocation, owning a home, and a seriously expensive divorce. As a Financial Coach, having been through this myself, and being trained as a CFP, I have the emotional and professional experience to support you in seeing things at a high-level, playing devil’s advocate, as well as providing financial education to help you make the right decision for your financial next steps.

We’ll help you:

- Identify, prioritize and quantify goals so that you’ll know when you met them

- Organize your financial information and develop a savings plan

- Create a debt payoff plan

- Develop strategies to support you in overcoming obstacles

- Understand the critical markers for measuring your financial improvement

“Thank you so much for our meeting with me last year. (Since then) I have purchased my first home, and have over 20K in my savings accounts because of the plan that we put together. Thank you for all the knowledge and your help!” – JD, AZ

“In the last year that I have been working with you, my net worth has increased substantially. A big part of that is due to your guidance in helping me understand my finances and investment accounts better… I appreciate that you are always available and that you are passionate about your work, thank you again for all your help this year and I look forward to working with you this upcoming year”. – IA, AZ

Financial Planning Before Divorce

Marriage and divorce are both common experiences nowadays, We have all heard the statistic that 50% of all marriages end in divorce and that this number is even higher for 2nd and 3rd marriages.

So what does that mean for you? The dissolution of a marriage is emotional, it can be stressful, and it can be devastating financially. From a financial standpoint it is no different than the dissolving of a business partnership, and should be given the same level of expertise and care. But more importantly it involves people lives, their hopes and dreams, the livelihood of their families, and as such, emotions need to be set aside so that you can work to mindfully and clearly focus on your financial future.

It’s not only important to be financially educated, but also to work with people who understand you. This a time when many concerns are surfacing; How financially secure will you be after the divorce… and for how long? Will you be able to maintain your standard of living and your relationships after it’s all said and done? How will you support yourself and your family on your own? Will you lose assets you brought to your marriage?

At Being Mindful In Divorce, we can work with you before your divorce decision to help you understand options and develop the best financial solutions for you and your family

Contact us to schedule your Divorce Strategy Session today!

Divorce Mediation Assistance

Mediators and even Attorneys may struggle with the complexity of property division, tax impacts, pension valuations, providing alternative settlement options, and optimizing settlements on both a Cash-flow and Net Worth basis 10,20-30 years into the future. Sometimes keeping the home is not the best decision. Self-employment income is difficult to determine. Determining the length of spousal is unclear. We can help you with all that and more.

We partner with these professionals to provide divorce financial planning expertise to their clients in support of the divorce process. Divorce settlement mistakes can last a lifetime, with advanced training and customized reports, we can help develop creative settlement options that make financial sense for both parties and create peace of mind.

Collaborative Divorce

Your marriage may be over and you understand the importance of working together to make the best financial decisions for your family. Collaborative divorce is a voluntary divorce resolution process that offers the services of legal, mental health, and financial professionals working together as a team in non-adversarial fashion; without litigation. Divorce is always difficult but having a team to help you come to quicker resolution without litigation can ensure you have control over the decisions, protect privacy, and reduce costs.

The collaborative processes involves a few unique points, including:

1. Both parties and the entire team signing a collaborative agreement that outline the scope and nature of the their participation in their roles and stipulates that the parties are all committed to resolution and will not go to court to resolve their differences.

2. The parties agree to voluntarily provide all relevant and requested information as part of the full disclosure settlement process and negotiate in full faith to reach a mutually agreed upon settlement.

3. Each party is represented by an attorney to ensure they feel heard and receive proper counsel. The attorney participation will terminate immediately in the case of any contested court proceeding.

4. The experts are engaged “as necessary” and their participation will terminate immediately in the case of any contested court proceeding.

5. The couple may always jointly engage other professional as needed. For example a Mortgage Broker, a Business Valuation or Insurance expert etc.

The collaborative process is about you and your family; with a team to support your values. It keeps control and confidentially in your hands and not in the courts. It allows parties to negotiate outcomes that are right for their families, honoring their priorities and exploring creative solutions that cannot occur in the litigation process. For more information about the Collaborative divorce process, please visit the web page of the Collaborative Professionals of Phoenix.

Certified Divorce Financial Planning

Maybe you are considering this step. Sometimes divorce is the only answer and you both agree. You are in a place in your lives where you can sit together, define priorities, negotiate an agreement, and value avoiding a costly litigation. Maybe you have used financial planning in the past, and even if you haven’t – you understand it’s importance to your long range financial outcome and acknowledge that you don’t know where to begin. Consequently, you value the financial guidance the divorce financial analysis process can bring in creating an equitable future for you both.

You have created a life that may include a home, a business, investment and retirement accounts (pension, IRA, 401K, TSP etc.) executive compensation, real estate or more. Reports reflecting your unique situation help in the development of financial “after tax” division that seeks to save taxes, avoids pitfalls, and let’s you know what your “post-divorce” lifestyle will look like. The transparent process puts control in your hands and allows you to see the future impact on your cash-flow and net-worth; not just a snapshot of this moment, because 50/50 is not always equitable when we take these aspects into consideration.

Financial Neutral

We’re here as your neutral “financial thought” partner, answering questions, posing questions, and making suggestions; to empower you both together to develop a settlement that honors your values and financial well-being.

Divorce Team Member/Financial Advocate

If you are working with an attorney, we can become part of your divorce team and provide key financial support for previous issues mentioned.

As well as:

- Creation of, or review and validation of completed financial affidavit forms.

- Presentation, litigation case support, and expert witness services in court or during mediation proceedings.

Forensic Type Analysis & Valuation

Maybe your spouse has self-employment income, maybe the tax returns don’t show the true cash-flow that has supported your family, maybe documents are disappearing or cannot be found.

It may make sense to hire a Financial Professional (FP) with an engagement for limited scope analysis work; perhaps a lifestyle analysis, cash flow analysis, or to identify changes in net worth that are incongruent with the tax return. This baby step approach can help keep costs down and determine if further analysis needed. The FP can begin by examining the individual Financial Affidavits, tax returns (personal & business), bank statements and the credit cards to identify undisclosed/hidden assets, funds used for non-marital expenses, personal expenses hidden as business expenses that reduced the profit of the business, overpayment of taxes (to reduce income), even double dipping on expenses etc.

Post-Divorce Transition Support

“Studies show that in the first year after divorce the wife’s standard of living may drops n average 27%, while a man’s rises 10%“

Most of the divorce upheaval is behind you, but you have concerns on how to keep your finances on track so your money will last. You know the amount of your divorce settlement; but your not sure how to ensure it will continue to be enough to cover your day-to-day living expenses, pay for college and get you all the way through retirement.

Will you outlive your assets? How can you ensure you can keep the assets you most treasure, rather than later selling them to survive?

In many cases once the divorce is finalized, the process is not complete; accounts and property may need to be titled in your name, old accounts may need to be closed, a QDRO may need to be executed, Wills/Trusts/Powers of Attorney etc. may need updating. Now this can seem overwhelming but you are not alone.

As a CERTIFIED FINANCIAL PLANNER™ with a background in Wealth Management, training in Estate Planning, Taxes, and Risk Management and as a Life Coach, I have the knowledge and experience to help you identify gaps in your current financial life, work with you to create a road map to meet your life goals and work with your trusted professionals (accountant, estate planning attorney & insurance agent) to maximize the implementation of recommendations and increase your chances for success.

56% of married women leave investment and long-term financial planning decisions to their husbands, and 85% of women who defer to their husbands believe their spouses know more about financial matters

Let us help you navigate this next phase of your life, and be your financial thought partner in creating “what’s next” with confidence.

Support services and Financial coaching in the following areas:

- Financial literacy around Investments; opening & consolidating accounts

- Retirement planning concepts and considerations

- Education Planning options & strategies

- Estate Planning gaps and areas for potential change or consideration

- Tax Planning concepts & strategies

- Insurance Planning & Risk Management concepts & gaps

“Michelle – Thank you, thank you, thank you, I can tell you are God-sent… completing the budget and exercises brought so much hope and peace.. seeing the light at the end of the tunnel and seeing hope in having control over my finances and moving to self-sufficiency, investing, and prospering.“ – MB, CA

“Michelle is honest, professional and incredibly hard-working. Her knowledge helped me through my divorce. She would be a true asset at the beginning of your divorce, after your divorce and comes with my heart felt recommendation. Thank you Michelle for everything you did for me!!” – Rosa Rabago, AZ

See How Using a CDFA® Can Save You Money During Divorce

Value Based Pricing

Working with a CDFA® can help you preserve more of your own money for you and your family. Value Based Service pricing is flat-fee and transparent based on the complexity of your unique financial situation, and since we do not manage your assets, this is “conflict free” advice. Scheduling a Financial “Next Steps” Strategy Session is the first step to understanding your finances, creating choices and peace of mind.

Your Divorce Doesn't Need to be Financially Devastating

Reach an agreement that is mindful and fair

Your Divorce Doesn't Need to be Financially Devastating

Reach an agreement that is mindful and fair

Your Divorce Doesn't Need to be Financially Devastating

Reach an agreement that is mindful and fairLet's Get Started!

About Us

Take your first step to creating the life you want now. A strategy session allows you to see options around financial decisions that will give you peace of mind again.

Follow Us: